About

01

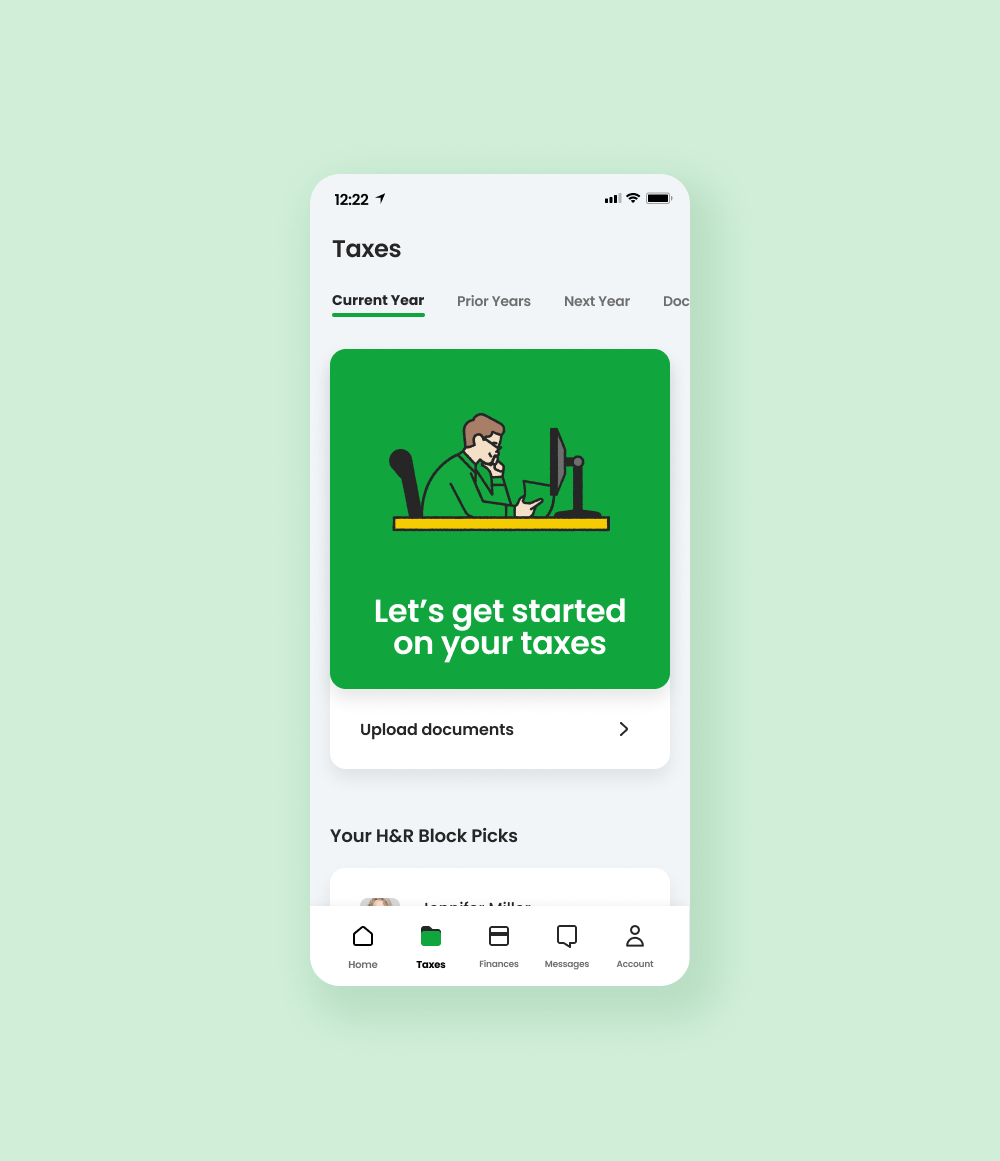

H&R Block is a leading American tax preparation company with offices spanning the nation and Canada, Australia, and Europe. The driving force behind everything H&R Block does is the mission to provide clients with care and expertise in all things taxes and doing so in a way that meets clients where they are – in person or virtually. Clients are at the center of the tax experience, whether they have a simple W-2 or complex small business needs.

Reaching a newly identified client segment meant there was a need to expand tax filing services. The goal was to tap into these new clients while still offering the same level of support clients expected from their neighborhood tax professionals.

Overview

Create an experience for clients to file taxes with a tax professional without going into the office.

Allow clients to let an expert file taxes for them from virtually anywhere.

Build a seamless experience for both the client and the tax professional that allows for easy and quick communication.

Enable the client to upload documents from any device and in a way that is easily accessible for the tax professional to get the best result possible.

Provide a clear path for the client and tax professional, from information gathering to payment through simple steps and expectations.

Goals

I worked with a team to build an entirely new tax filing experience that allows clients to get expert tax services completely virtually, from ideation to execution. This unique filing experience included but was not limited to information gathering, tax filing, payment processing, and communication methods.

We worked to improve and elevate the experience each year to ensure client needs were consistently satisfied.

Actions

Led overall design efforts and consulted on user experience requirements to ensure the best outcomes possible. Some responsibilities included:

Steered the experience design.

Guided visual design efforts.

Completed prototypes for the core team and C-Suite presentations.

Built wireframes and journey maps.

Helped conduct user testing and in-person focus groups.

Collaborated with development teams on requirements.

Role

Results

We saw excellent results throughout. A few highlights include:

11,500%

Growth in over four years.

215%

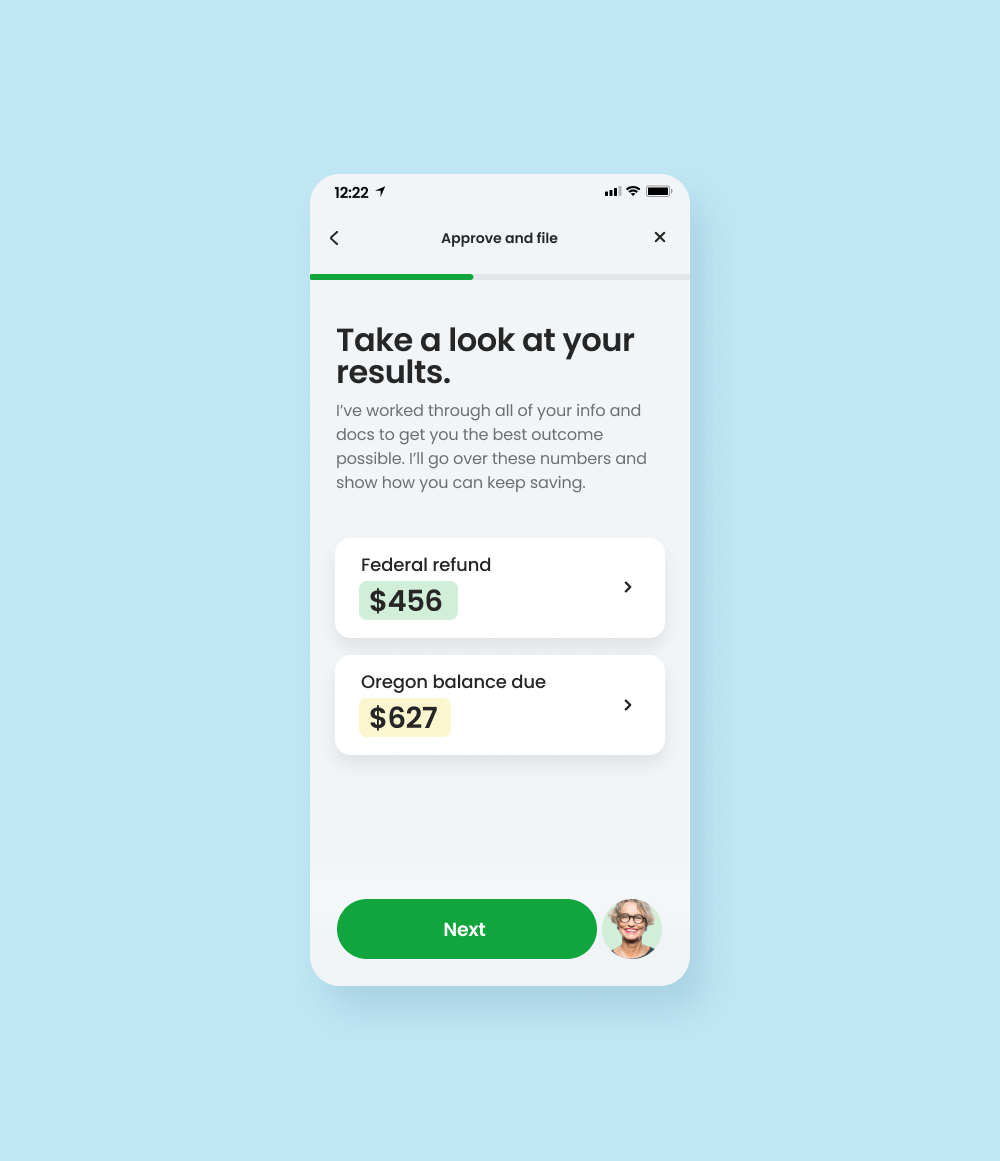

Increase in year-over-year approval experience.

400%

Rise in tax professional satisfaction year-over-year.

53%

Year-over-year increase in NPS score.

10%

Better in NPS scores in the approval process than the in-office experience.

5%

Better in fair price and value than the in-office experience.

25%

Overall better NPS scores than the in-office experience.

Define

02

Ages 18-34

Clients who lean towards assistance but are more inclined to do their own taxes than visiting an office.

Clients who don't want to be present during tax preparation and prefer as little involvement as possible.

Clients who struggle doing their taxes on their own and need support.

Target Audience

Avoid paying anything out of pocket to have taxes done by an expert.

Pay as little as possible to prepare and file taxes.

Ensure there's no risk of an audit thanks to steps taken by the tax professional.

Get refund money immediately.

Needs

Incapable of preparing taxes alone.

Desire to save time by letting an expert prepare and file taxes.

Prefer to leave tax documents with a tax pro and pick them up once completed.

Want a refund faster by having an expert prepare and file taxes.

Attitudes

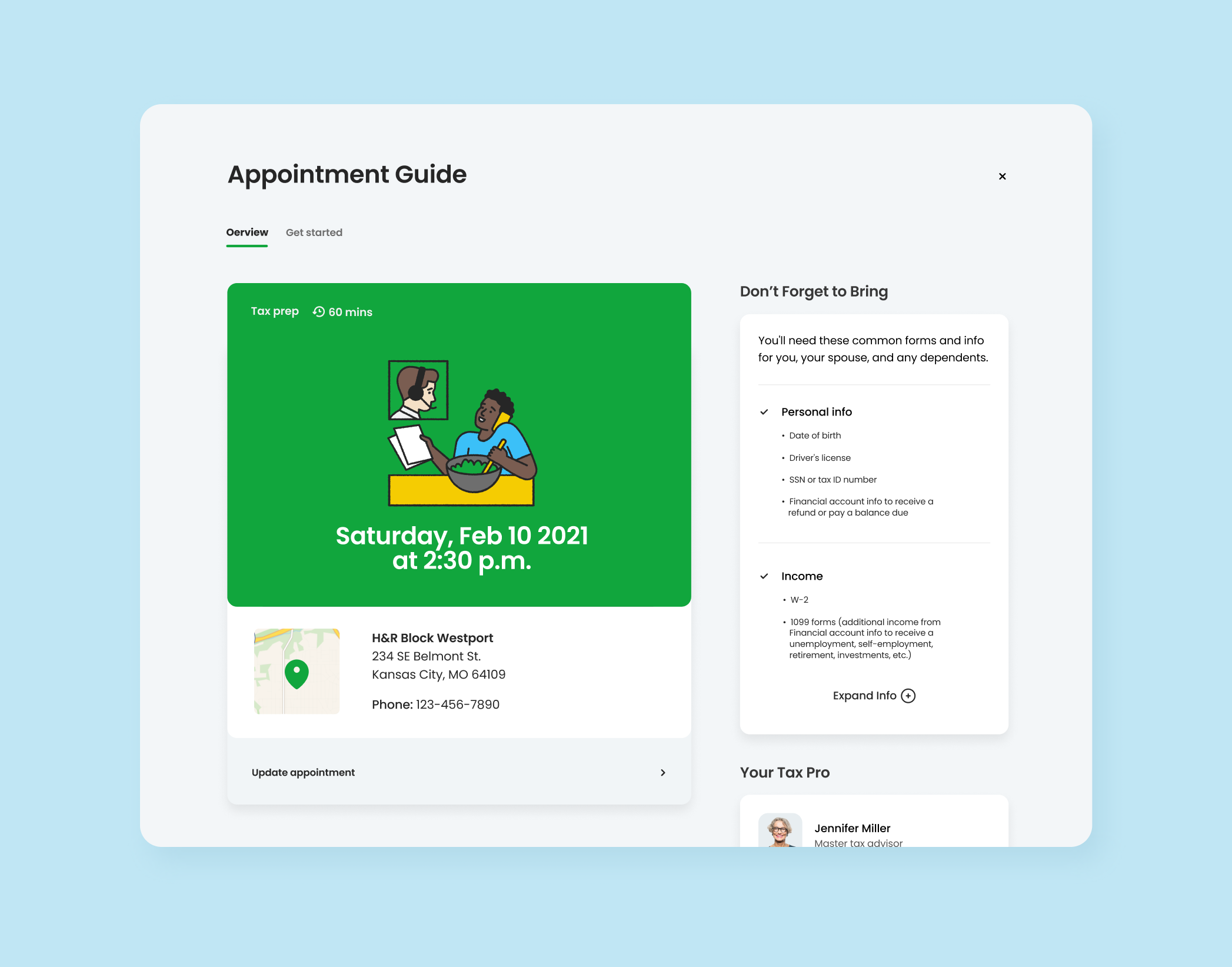

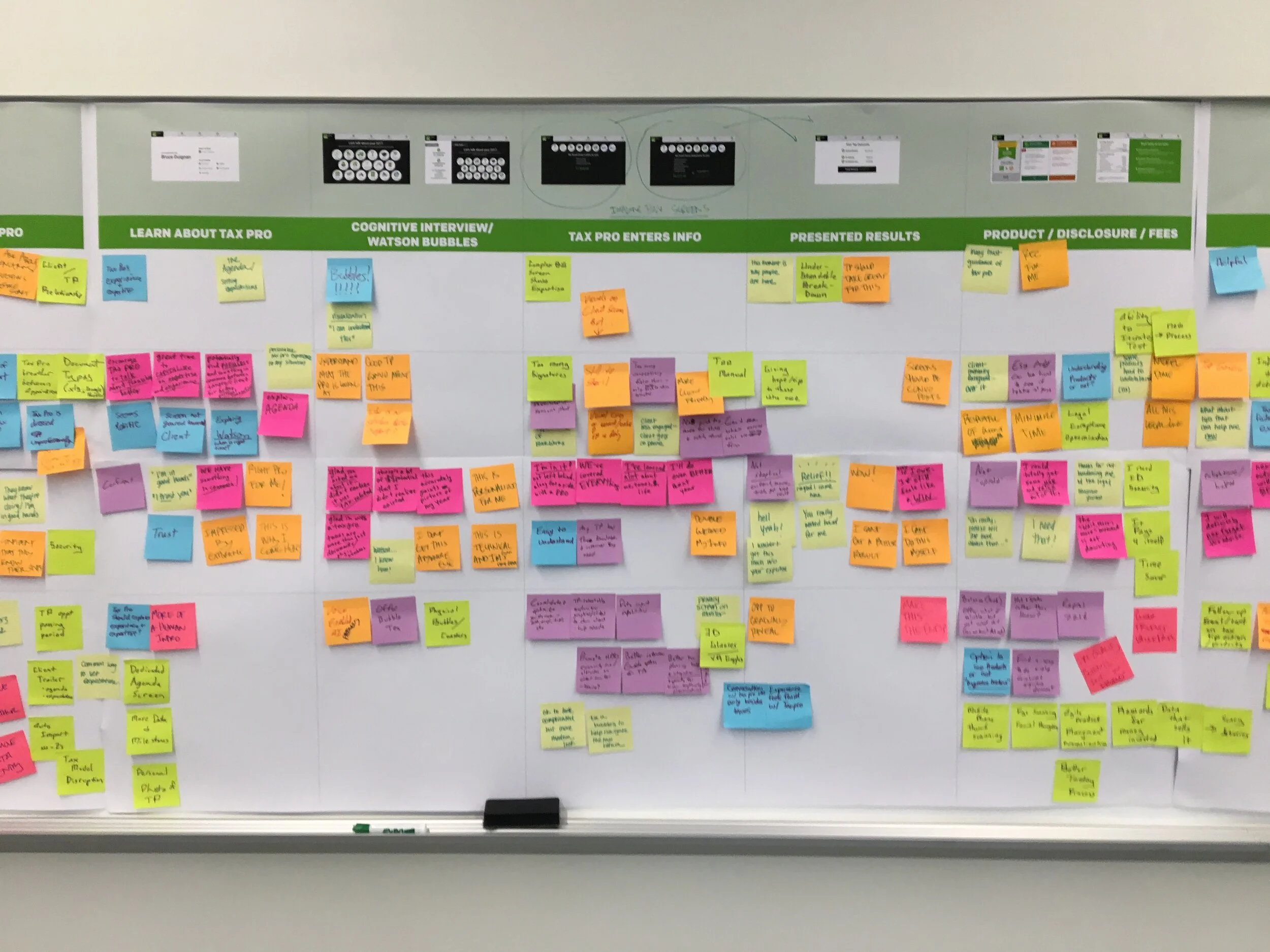

After initial research and understanding we began dreaming up what this experience was going to be. Design workshops were initiated with team members from design, tech, product, leadership, and tax professionals.

Ideation

We put together initial journey maps and flow diagrams to help visualize how much involvement would be required from the client, tax professional, and technology in the virtual tax prep experience.

Journey Mapping

Prototype

03

Our team sketched and built multiple interactive prototypes for user interaction. We tested the experience as a whole and parsed out critical key features for testing to ensure we were targeting the right audience.

Build, test, repeat

Form input and sticky nav

Communication fab

Experience status bar

List button drop down

Focus Areas

04

Creating forms that allowed clients to fill in enough information for the tax professional to work with to get the max refund but didn't overwhelm the client was a vital goal for the client experience and the business.

We were charged to create an experience that wasn't lengthy, tedious, or gave the impression of the client being left alone. On the other end, we also had to ensure we allowed tax professionals to gather enough information to do their jobs accurately and well.

Solution

Include a set of five additional screens to gather more information from the client. We introduced the experience by presenting a client benefit of a potentially larger refund if the extra, optional questions were answered.

Problem statement: As a client, I want the option and way to answer more questions about my tax situation in order for me to receive the best possible outcome I can.

A. Information Intake

Result: 100% of clients agreed to answer the extra questions during initial user testing, and 99.7% agreed inside the experience.

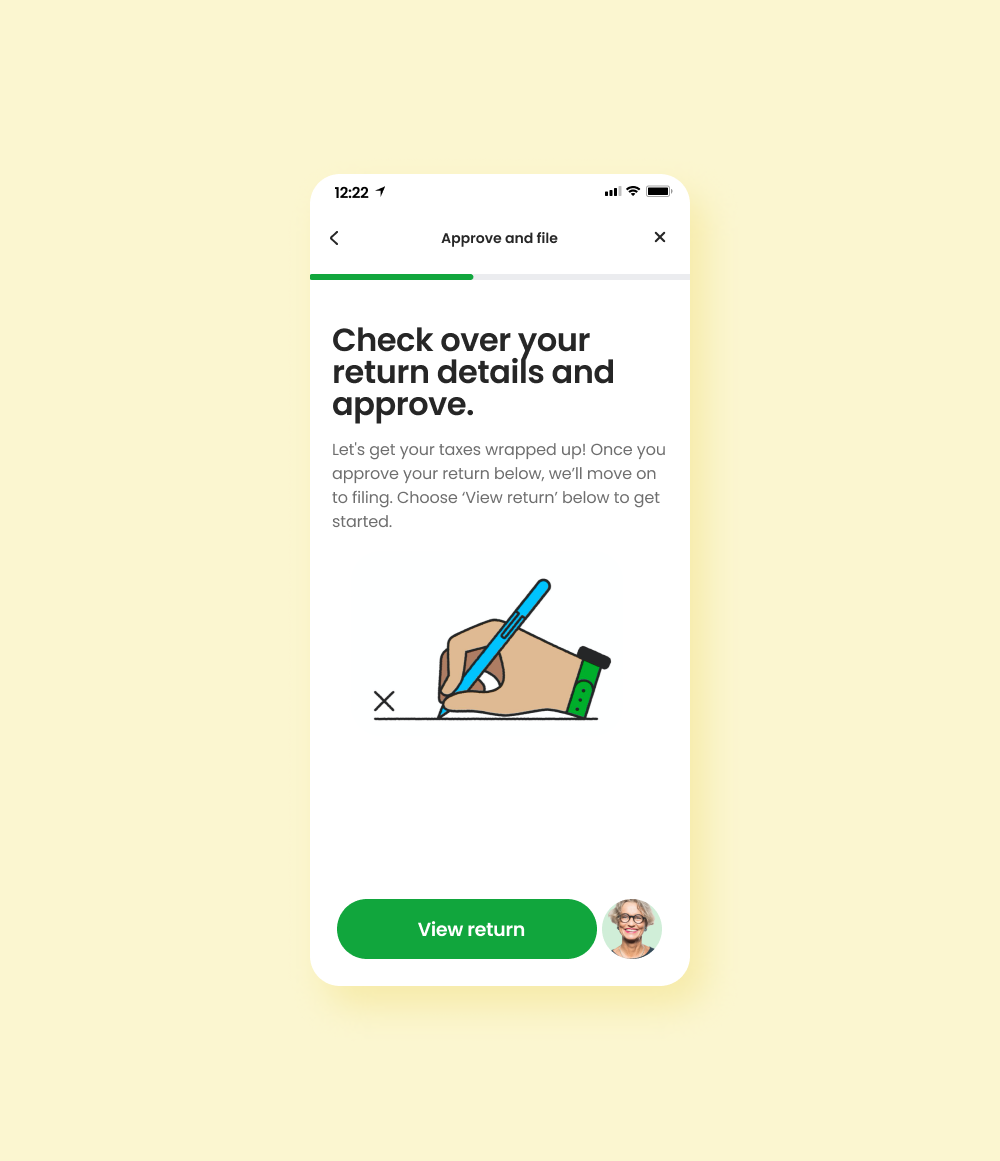

A business priority of the experience was to provide the expertise, and care clients received in an office and not typically offered inside of a complete do-it-yourself product. Additionally, we wanted the tax professional to be a part of the experience as much as possible without introducing friction.

To do so, we put the content in first person and included the tax professional's headshot to emulate the experience of conversation outside of screens.

Solution

We offered clients the ability to schedule a phone call with the tax professional at a specific point in the flow if the client wanted to speak more in detail or had additional questions.

Problem statement: As a client, I want the option and way to schedule a phone appointment within the experience in order for support and confidence to move forward.

B. Expertise and Care

Result: The option for scheduling a phone call had a 67% take rate. When interviewed, clients and tax professionals alike loved the feature to have a deeper conversation around getting the best possible outcome. Additionally, the feature contributed to the 400% year-over-year increase in tax professional satisfaction.

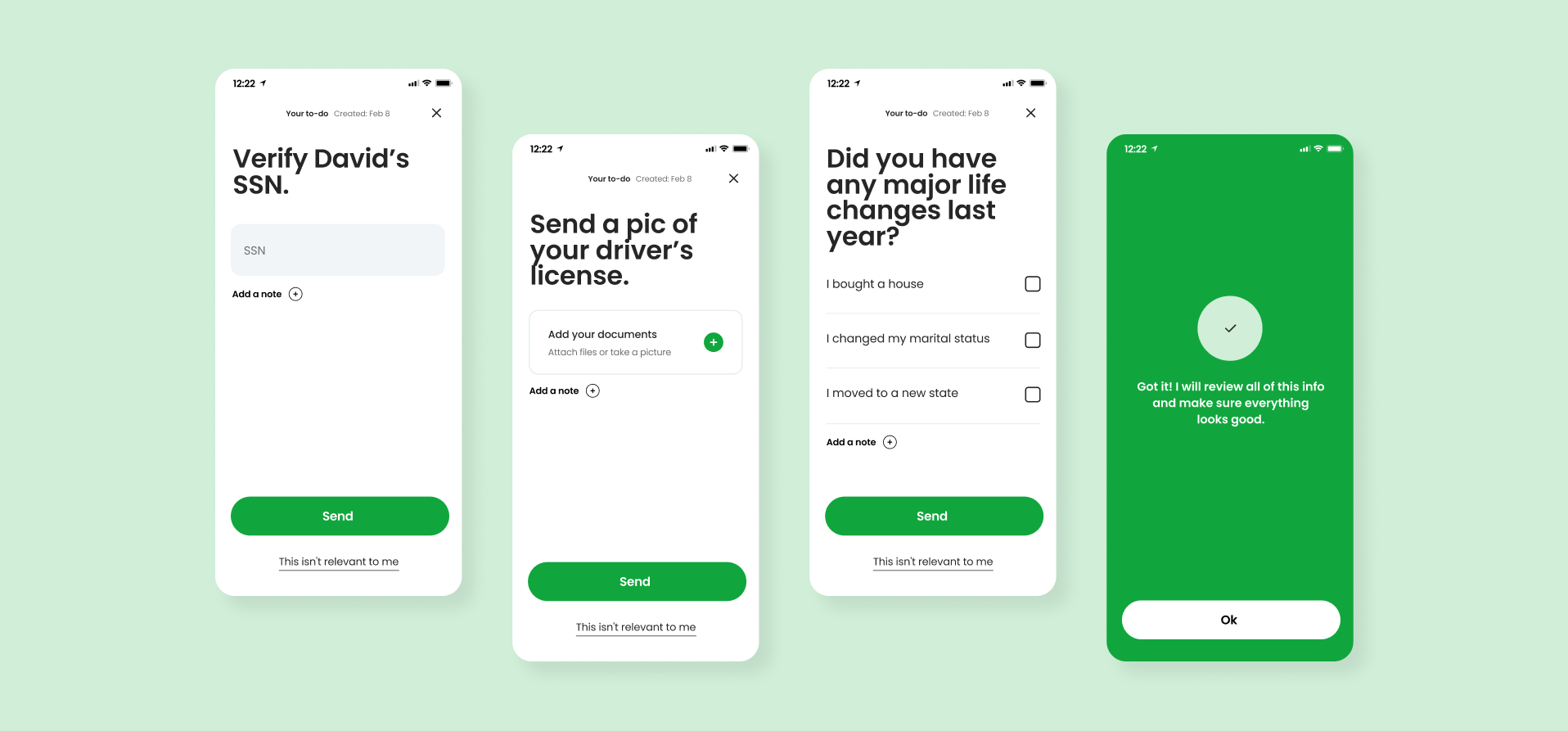

The tax professional can sometimes require more information from the client while preparing taxes. This can be because the client didn't send all of the necessary info initially, or the tax professional wants to confirm various items. It was apparent that an easy, efficient communication tool was needed.

Solution

We created a to-do list feature the tax professional could leverage to make clients aware when extra info was needed to finish their taxes. This feature helped the tax professional organize and request info and gave the client a simple, quick way to submit info.

Problem statement: As a client, I want a way to send more information to my tax professional during the tax preparation phase that is clear, efficient, and organized.

C. Filing Progress

Looking Ahead

05

Research shows clients and tax professionals struggle to communicate despite the abundance of tools available. In fact, the argument can be made that the number of tools available can cause confusion on which one to use. We also found that clients can get confused about their status when in the experience.

Solution

Eliminate underutilized tools and lean into the ones that benefit both the client and tax professional. The experience works best when the client and tax professional align on which tools to use for communication – the enterprise messaging system. Additionally, we recommend the client and tax professional have a phone call or video session to ensure every piece of information is gathered correctly.

We also recommend elevation of the enterprise messaging system to make the tax professional's expertise and care more visible.

Finally, we'd like to see the implementation of a three-step status indicator in the experience that allows clients to engage and see the current progress.

Recommendations

What clients are saying

“Super easy to use! It was so fast and effortless. My tax pro took care of me!”

“This was so easy it didn’t feel like I was doing my taxes.”